tax lien nj sales

New Jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale.

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

. Middlesex County NJ currently has 11712 tax liens available as of April 29. Tax sale liens are obtained through a bidding process. Third parties and the municipality bid on the tax sale certificates TSC.

Jail Phone 609645-5855 Fax 609909-7451. New Jersey Tax Deed Sales New Jersey does have tax deed sales. Added omitted assessments Sewer charges Special assessment charges Taxes Water charges Tax Sale Process.

Ad Compare New Jersey foreclosed homes by neighborhood schools size more. Anyone wishing to bid must register preceeding the tax sale. Any interested parties please send a self-addressed stamped envelope requesting for a tax sale list when it becomes available to.

Of the 20th day of the month after the end of the filing period. You do not have to wait until the due date to file. For a listing of all parcels delinquencies and costs including registration and bidding instructions please visit the Tax Lien Auction site.

Sales and Use Tax Online Filing and Payments. A judgment entered in court that is available for public view. In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale.

Theres only one problem for the smaller liens that are less than 1500 you only get 8 on the subsequent tax payments until the total delinquent amount is 1500. Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale.

Videos you watch may be added to the TVs watch history and influence TV recommendations. Atlantic County Sheriff and Jail. New Jersey is a very competitive tax sale state however and if there are any liens left over they are usually for junk properties.

18 per annum and 4 6 penalty. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. Tax Collectors Office Township of Teaneck 818 Teaneck Road Teaneck NJ 07666 2022 notice of sale for non-payment.

This helps raise money for the municipal budget but can cause other problems particularly with abandoned properties. Ad Looking for new jersey tax lien sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Middlesex County NJ at tax lien auctions or online distressed asset sales.

Municipal charges include but are not limited to. If the due date falls on a weekend or legal holiday the return and payment are due on the following business day. Content updated daily for new jersey tax lien sale.

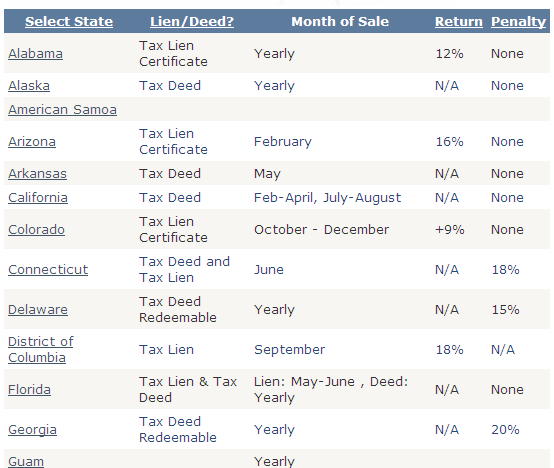

HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Documents Tax Sale List PDF. Interest Rate 18 or more depending on penalties.

Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30. Redemption Period 2 years New Jersey Tax Lien Auctions Dates of sales vary depending on the municipality. Here is a summary of information for tax sales in New Jersey.

Comprehensive listings of foreclosures short sales auction homes land bank deals. New Jersey Tax Lien Certificates In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales. The City of Trenton announces the tax sale of 2019 2nd quarter and prior year delinquent taxes and other municipal charges through an online auction.

Quarterly Sales and Use Tax Returns are due before 1159 pm. Its purpose is to give official notice that liens or judgments exist. So if you have a good lien that you know will eventually pay off you can continue to pay the subsequent taxes and get the maximum rate on your these payments which is 18.

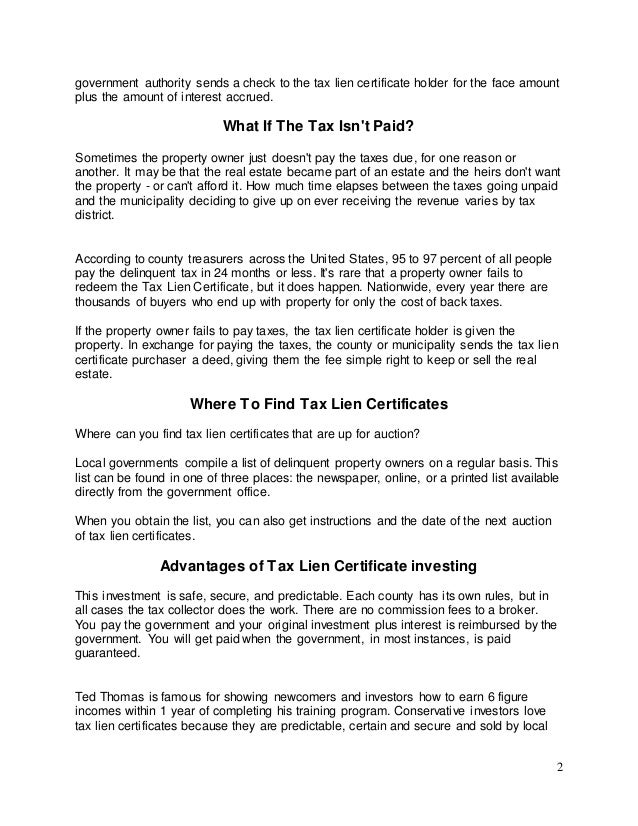

You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner. Tax Lien Certificates Sec. Liens may also be sold or assigned to another investor.

4997 Unami Boulevard Mays Landing NJ 08330. CODs are filed to secure tax debt and to protect the interests of all taxpayers. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

If playback doesnt begin shortly try restarting your device. If the lien is not redeemed within the 2-year redemption period the purchaser may start foreclosure on the property. Tax sales are conducted by the tax collector.

A tax lien is filed against you with the Clerk of the New Jersey Superior Court. Interest Rate andor Penalty Rate. Sheriff Jail and Sheriff Sales.

Search Atlantic County inmate records through Vinelink by offender id or name. Phone 609909-7200 Fax 609909-7292. Just remember each state has its own bidding process.

Check your New Jersey tax liens rules. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. New Jersey is a good state for tax lien certificate sales.

By selling off these tax liens municipalities generate revenue.

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

Tax Lien Investing Pros And Cons Youtube

Tax Sale Support 4 000 000 New Jersey Mansion With 50k Tax Lien Nj Tax Sale Review Facebook

Where Are The Tax Sales Tax Lien Investing Tips

Beware Of The Accelerated Tax Sales In New Jersey Tax Lien Investing Tips Jersey New Jersey Jersey Girl

Profiting On Hud Properties Tax Lien Investing Investing Real Estate Investing Free Webinar

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Tax Liens An Overview Checkbook Ira Llc

What Are Tax Lien Certificates How Do They Work

How To Remove A Lien On Your Home New Home Buyer Us Real Estate Lets Do It

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

Understanding Nj Tax Lien Foreclosure Westmarq

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Bid Campaign New Jersey

Tax Lien Certificate Investment Basics

Tax Certificate And Tax Deed Sales Pinellas County Tax

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas