am i taxed on stock dividends

40001 for those filing single or married filing separately 54101 for head of household filers or. However as the 401 k example shows these dividend-yielding stocks are susceptible to similar fees and taxation.

And heres something nice.

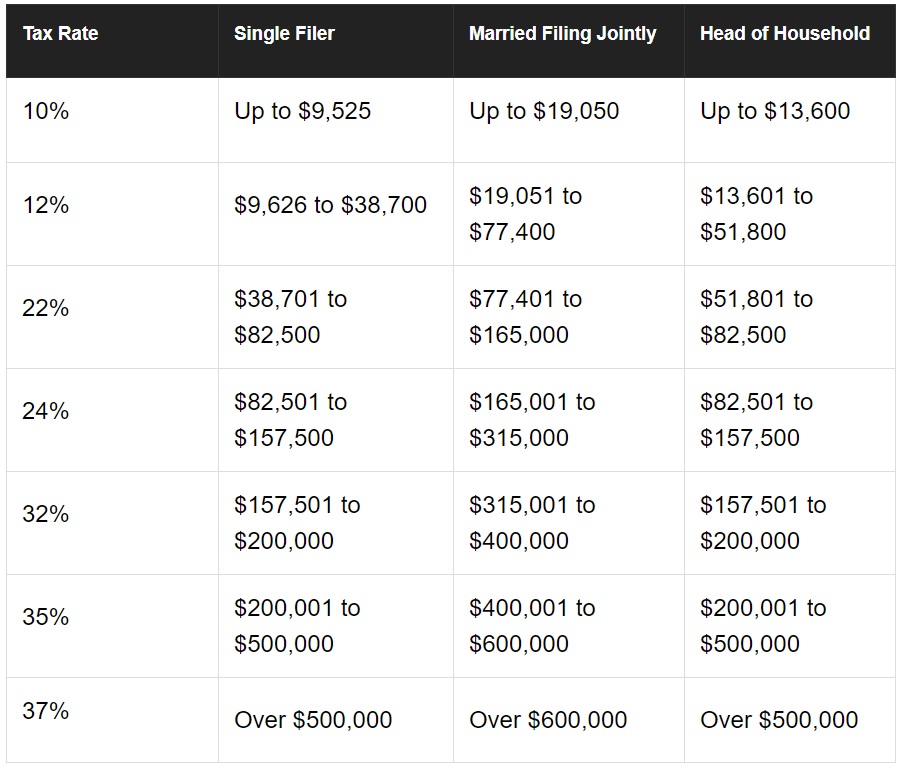

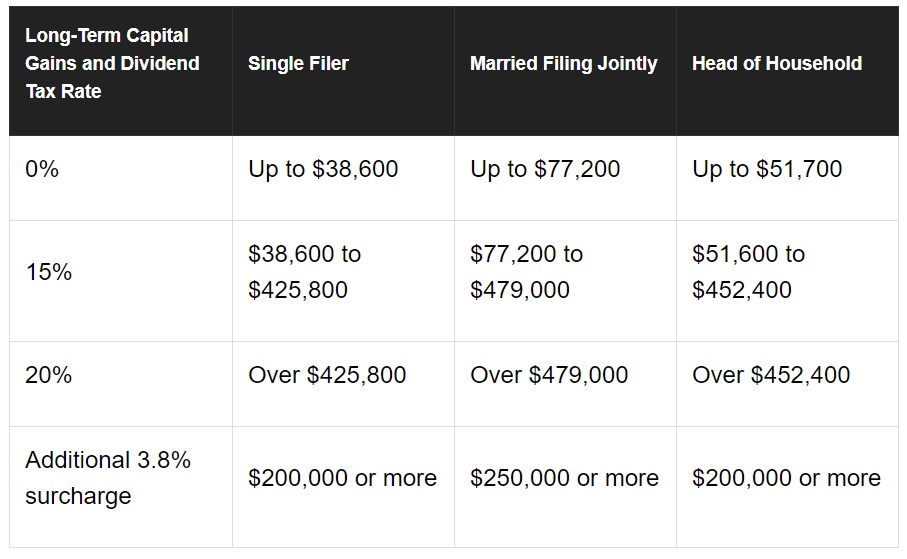

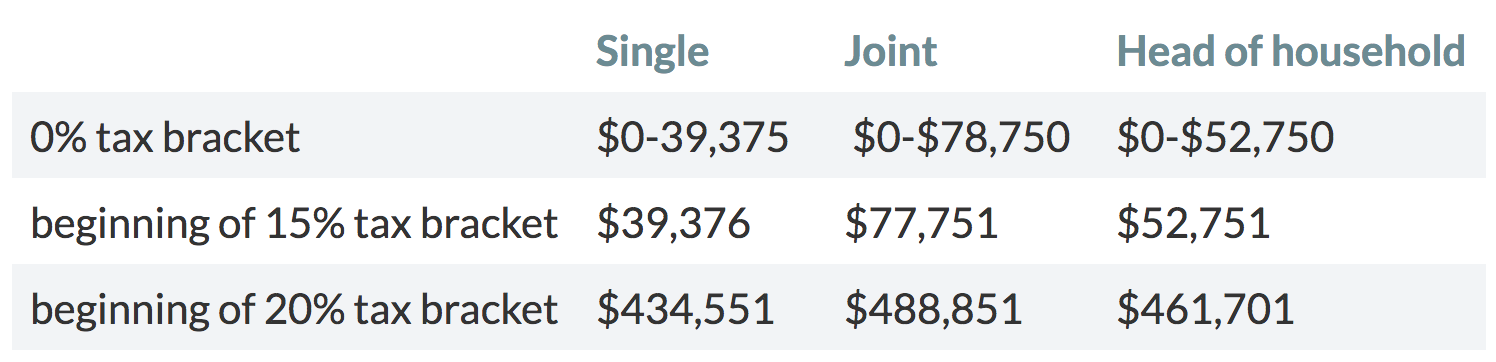

. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent. Qualified dividends were taxed at rates of 0 15 or 20 through the tax year 2017. Am I Taxed On Stock Dividends Double taxation of dividends differential taxation of stockholders and income tax relief taxation of corporate earnings to discuss the personal income tax on dividends and neglect the fact that the corporate earnings out of which dividends are paid have been taxed at the corporate level as in the first part of chapter 3 does.

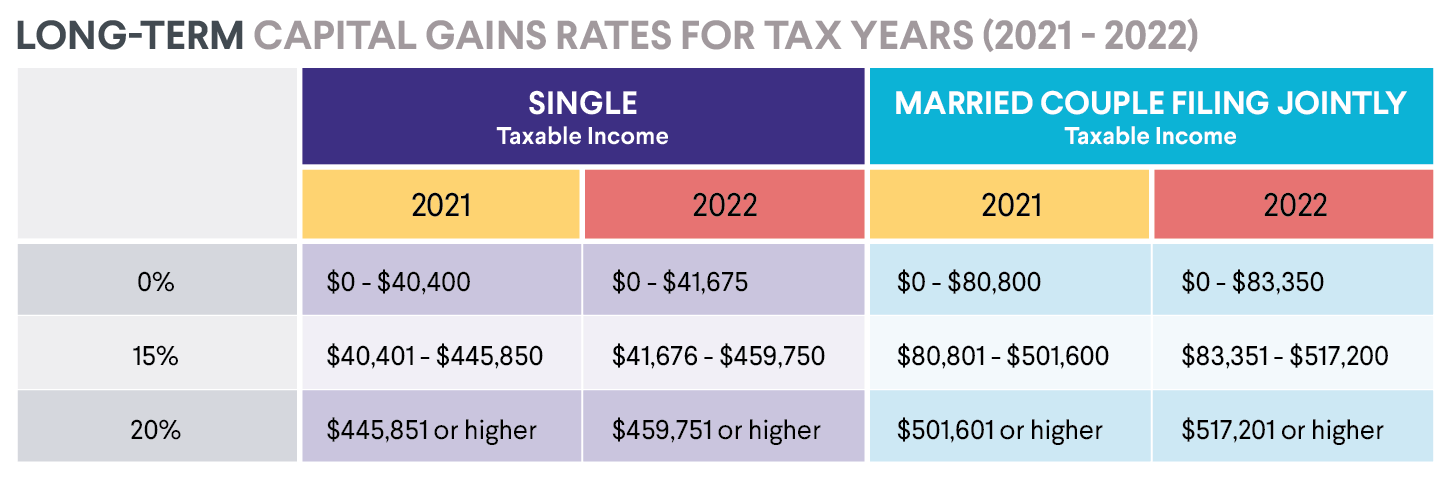

Qualified dividends are taxed at long-term capital gains rates. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. ABC Pty Ltd decides to retain 50 of the profits within the business and to pay shareholders the remaining 175 as a fully franked dividend.

Dividend Tax Rates for the 2022 Tax Year. The long-term capital gains tax rates are 0 15 and 20 and depend on your income and are much lower than the ordinary income tax rate. To work out your tax band add.

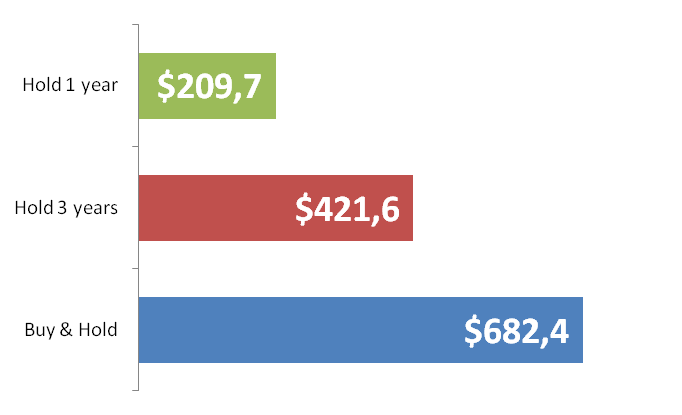

The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. By the end youre going to lose 365 of your dividend income to taxes. Preferred stock dividends can generate tremendous growth in a tax-sheltered account especially if they are reinvested regularly.

80801 for married filing jointly or qualifying widow er filing status. Ordinary non-qualified dividends. 505 on the first 46226 of taxable income.

Your tax bracket alone is going to influence your qualified dividends tax rate. Qualified dividends come from investments in US. The benefit of retirement accounts is that your money grows tax-free until retirement.

Ontario tax rates by tax bracket are shown below. Examples in this article will use Ontarios tax rates as it is Canadas most highly-populated province. The next step down at a 15 rate is anyone who records 78751 to 488850 in taxable income.

If your income is low you might qualify for the 0 long-term capital gains rates and wont have to pay tax on your dividends. If shares are held in a retirement account stock dividends and stock splits are not taxed as they are earned. Am i taxed on stock dividends.

For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. 915 on the next 46228. Dividend-paying companies send investors copies of Form 1099-DIV.

In 2018 that puts you in the 24 tax bracket which means that 9000 becomes 6840 after taxes. The rates are set at 0 15 and 20 just as they have always been. When you hold your money in a Roth IRA you will not pay any taxes on dividends.

Qualified dividends are taxed at a lower rate than ordinary income at the capital gains tax rate. Qualified dividends come from investments in US. If youre in the 10 to 15 percent bracket then youre not going to be taxed anything on qualified dividends.

Tax rate on dividends over the allowance. Currently the maximum tax rate on qualified dividends is 20. Why am I taxed on reinvested dividends.

Pin on Investing. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period. Lastly investors that were in the four middle brackets 25 28 33 or 35 paid a 15 tax rate for their income derived from qualified dividends.

It must pay 30 tax on that profit which is 150 per share leaving 350 per share able to be either retained by the business or paid out as dividends to shareholders. This information is included on the individuals Form 1040. In the case of the cd the 3000 is taxed as ordinary income.

The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income. The tax rate on nonqualified dividends is the same as your regular income tax bracket. 1 Generally in a nonretirement brokerage account any income is.

1116 on the next 57546. Dividends are reported to individuals and the IRS on Form 1099-DIV. The exact amount will depend on the dividend yields for the stocks you buy for your portfolio.

The qualified dividend tax rate increases to 15 for taxable income above. Non-qualified or ordinary dividends which include most dividends paid to shareholders are taxed at short-term capital gains. The Internal Revenue Service IRS imposes a 20 capital gains tax rate for filers who exceed the 15 threshold.

To see why you should have a stocks and shares isa check out trading 212 invest vs isa. The 15 tax rate applies to just about all of the income covered in the 22 24 32 and 35 tax brackets. Long-term capital gains tax rates are usually lower than those on.

Dividend Tax Rates for the 2022 Tax Year. You still need to pay taxes either before or after you contribute the money but you will not have to pay. Am i taxed on stock dividends.

The dividends cant be non-qualified certain criteria must be met for this and. The benefit of retirement accounts is that your money grows tax-free until retirement. In order to make 500 a month in dividends youll need to invest approximately 200000 in dividend stocks.

The rate depended on the taxpayers ordinary income tax bracket. As mentioned provincial tax rates vary by province. Long-term capital gains tax rates are 0 15 or 20 depending on your taxable income and filing status.

These next two tables present the tax rates assessed on ordinary or non-qualified dividends in 2021 and 2022 depending. Dividends are a form of income and as such they must be reported in your income tax return. For stock dividends it depends on the type of account.

Then the Tax Cuts and Jobs Act TCJA came along and changed things up effective January 2018. Qualified dividends are taxed at long-term capital gains rates. Specifically you must record 488851 or more in taxable income as of the 2019 tax requirements.

The 0 tax rate applies to all of the income in the 10 and 12 brackets.

What To Know About Paying Taxes On Stocks Sofi

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Dutch Equity Income Tax System Tax Rates And How Does It Work Taxable

Tax On Dividend Income Taxation On Dividend Income In India Ddt Indmoney

Dividend Tax Rates In 2021 And 2022 The Motley Fool

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What Tax Do I Pay On Savings And Dividend Income Low Incomes Tax Reform Group

Capital Gains Tax Would Buffett Prefer To Live In Holland

Ultimate Guide To Dividend Tax 2021

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Dividend Tax 2021 22 Explained Raisin Uk

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Finances Money

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)